Tariff Troubles

Europe's age of uncertainty

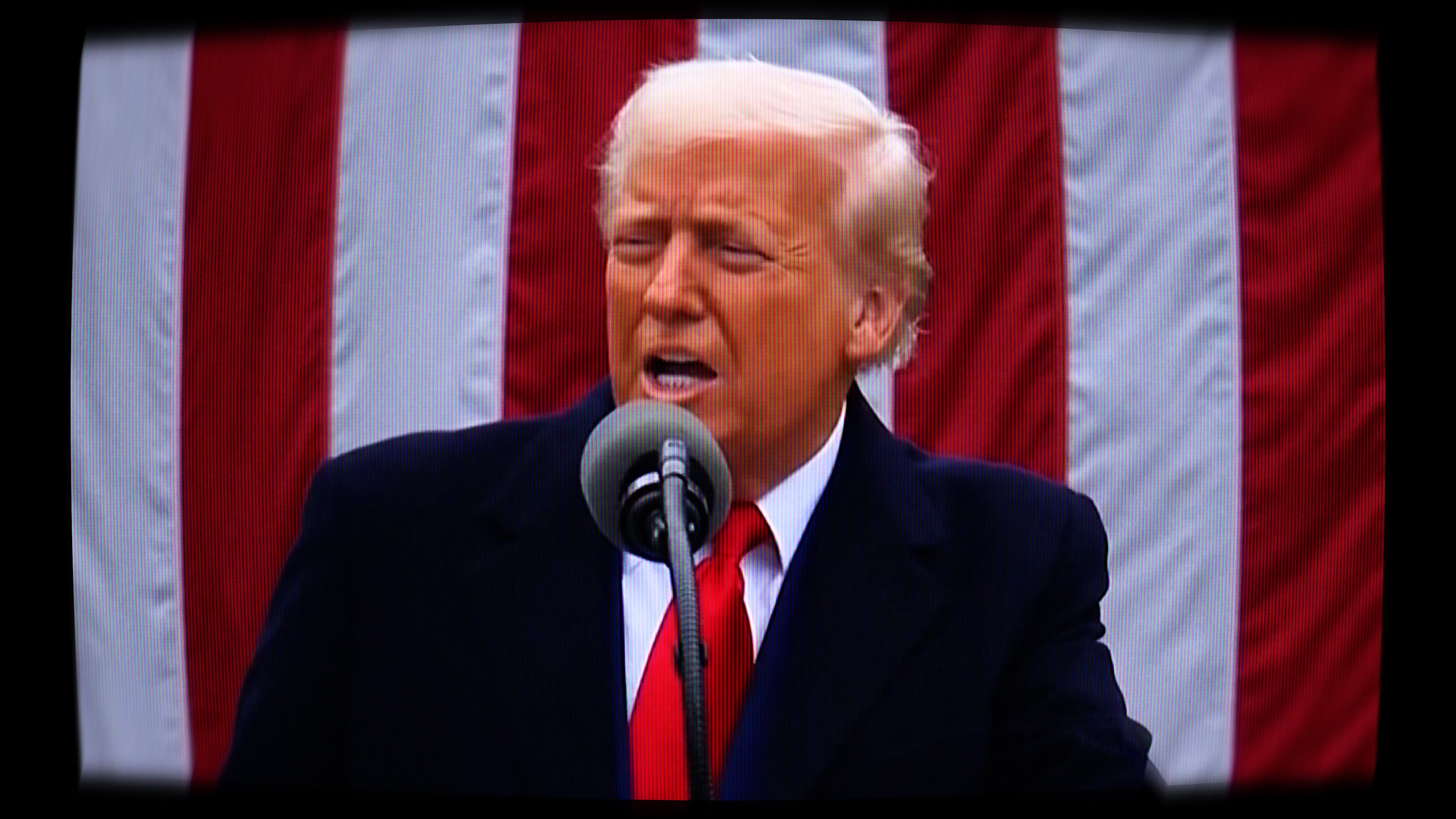

In April 2025, U.S. President Donald Trump reignited global trade tensions by announcing sweeping new tariffs on dozens of countries, sending shockwaves across financial markets, supply chains and economies around the world.

In CGTN Europe's new documentary Tariff Troubles: Europe's Age of Uncertainty, reporter Iolo ap Dafydd explores how this unpredictable 'tariff war' is impacting Europe's heritage industries, from Ireland to Switzerland and Italy.

Through on-the-ground stories and expert insights, the film traces the real human and economic consequences of shifting U.S. trade policy.

CGTN's Iolo ap Dafydd crossed Europe to track the story.

CGTN's Iolo ap Dafydd crossed Europe to track the story.

Ireland

"The Irish diaspora in America is huge and they love anything Irish."

In Cork, Irish distillers fear the collapse of fragile new ventures. Michael Scully, the CEO and Founder of Clonakilty Whiskey, creates a special type of whiskey using barley infused with sea salt.

"We've invested a lot in the American market," he said. "The Irish diaspora in America is huge and they love anything Irish. And while it's competitive, I think that will remain to be an advantage for us in that market."

Ireland has previous experience of U.S. legislation sealing off a crucial export market. Ireland used to be the biggest whiskey supplier to the United States, but this vital industry collapsed in the 1920s because of Prohibition laws banning alcohol.

As Irish economist and podcaster David McWilliams pointed out, "when America closed off its booze, the Scots were allowed and could still sell to Canada because Canada was part of the British Dominion. We lost the entire industry. So we know what happens when America closes. Our industry folds."

Scully is now switching his focus to other markets in Asia and Africa.

"We have actually got a consultant working for us for the last nine months in China, and we do expect that we will be making inroads into the Chinese market really soon," he said.

Northern Ireland

"We knew there was a possibility of these tariffs coming in – but there was no going back."

The situation isn't any more certain across the border in Northern Ireland, which – as part of the United Kingdom – is subject to a smaller tariff of 10 percent.

Peter Lavery is a former bus driver turned millionaire entrepreneur thanks to a Lottery win. He has created Belfast's first distillery in 80 years and while tariffs will certainly impact on his export plans, he says it's too late to turn back.

"We knew there was a possibility of these tariffs coming in but at the same time, there was no going back," he said. "We're still heading to the States to work away at it. And hopefully we'll do OK."

Switzerland

"The big risk for us is to lose knowledge, to lose expertise. If there's no work for those people, they will disappear."

The Swiss watch industry employs over 60,000 and is worth over $60 billion. Not only is it central to Switzerland's image and identity, it's also its third biggest export industry.

The United States is its biggest market and accounts for a fifth of all its exports – which is why the 39 percent tariff introduced by Trump, the fourth highest globally, sent the industry reeling.

"We're a very small country, 8.5 million inhabitants, but we are very powerful in terms of economics," said Oliver R. Müller, a watch industry expert and the founder of a luxury consulting agency.

"Switzerland will probably prevail, so as to say… we've always managed to get through storms. The Americans thought that we were really the bad guys because we had a huge gap between what we import and what we export."

In Zurich, Swiss watchmakers are worried about losing centuries of legacy and precision. Edouard Maylan is the chief executive of H. Moser and co, a small family business which dates all the way back to 1822. He said his business has had a "record month in terms of sellout" – but this may be people buying in advance of possible tariff hikes.

Regardless, he thinks the industry will have to come together and create a unified approach so vital heritage skills aren't lost.

"We need to work as an industry," he said. "We need to think of it more as a corporation and really developing an ecosystem. And when we suffer, we all suffer together.

"It's the responsibility sometimes of the brands to also support the network of suppliers. Because the big risk for us is to lose knowledge, to lose expertise, because if there's no more work for those people, they will disappear."

Italy

"To the Italy brand, this is part of soft power."

Italian food is admired across the world, especially its wine, meat and cheeses. Every year, tons of produce is exported globally, especially Parma ham and of course Parmigiano cheese.

"Food is our second [most] important sector in exports," said Professor Lucrezia Reichlin, an economist and teacher at the London Business School "It's worth between 60 and 67 billion euros [$71-79bn]. That is about 10 percent of Italian exports and it accounts for 4 percent of GDP."

But more crucially, she says, food products are related to the "Italian image, to the Italy brand – this is part of soft power."

In 2024, 16,000 tons of Parmigiano Reggiano was exported from Italy to the United States, about 22 percent of its total overseas sales - making America the biggest foreign market. It's sold in the U.S. at more than twice the price of domestic alternatives and it was worth around $300 million to Italian cheese exporters in 2024. Because of its iconic status within the industry, it's known as the king of Italian cheeses.

In Parma, iconic food producers worry that higher costs will drive American consumers toward cheaper alternatives. The country's largest exporter of Provolone cheese is Auricchio – founded in 1877 by Gennaro Auricchio, and still owned and run by his great-grandson Antonio and his brothers.

Asked about the impact on his business, Antonio predicted "we lose half, because it's impossible, too expensive. If the price goes up and Italian Parmigiano is too high, people will choose another quality [cheese] instead."

An economic corona?

"Trump has triggered the economic equivalent of the corona pandemic."

As uncertainty spreads, business leaders and economists are realising how important a role confidence plays in global markets – and how weaponizing tariffs in a deeply interconnected world can easily undermine it.

As David McWilliams pointed out, if you "destroy the certainty, as Donald Trump was doing, you destroy the confidence, people retrench and what you find is that economic confidence travels across the world like a virus. It's like a pandemic.

"When we are confident, we are confident together. When we are nervous, we get nervous together. And that's exactly what Trump has done. He's triggered the economic equivalent of the corona pandemic in the minds of people who make the decisions."

The full documentary:

Supervising Producer Mei Yan

Executive Producers Neil Cairns, Xie Zheng

Senior Producer Makez Rikweda

Writer/Producer/Director Nicholas Ahlmark

Reporter Iolo ap Dafydd

Director of Photography Joshua Halvatis

Assistant Camera Benjamin Croce, Andrei Scintian, Paul Izzard

Sound Recordist (Ireland) Aaron Liburn

Fixer (Switzerland and Ireland) Antonino Galofaro

Editor Joshua Halvatzis

Online Editors Paul Izzard, Reza Pashankpour

Production Coordinator Tanya Clancy

Shorthand Gary Parkinson